I bought myself a genetic test from 23andme.com for Christmas and the results just came back and I’ve got a 37% chance of getting prostate cancer. Given that there are very few men in my family (so not much of a family medical history for prostate cancer) that’s really useful information. (I have 4 sisters and no brothers, my dad had 5 sisters and no brothers, and my mom only had 1 brother.) While I’m not going to worry about it too much, I think I’ll find a proctologist and get regular exams for prostate cancer. 37% is pretty substantial risk.

I’m also at increased risk for age related macular degeneration (9.5%), melanoma (4% + my father has had skin cancer), and a few other things – all of which are still pretty unlikely even with “elevated risk”. There are also a few diseases where I’ve got a lower than average risk – Restless Leg Syndrome, Rheumatoid Arthritis, etc.

They also break down how likely drugs are to work on me. I’m more likely than average to be a heroin addict 🙂 Coumadin (which I think my father takes) will work better on me than most people, and so on.

Being gay I’ve always wondered if I was immune or resistant to HIV. Turns out I’m neither. (10% of Northern Europeans are resistent and 1% are immune to most forms of HIV). There’s are also genes that can predict whether your likely to be one of the lucky few whose bodies can keep HIV in check without medication – one of those genes suggests I’m completely average and have no special protection, but emerging research on another gene suggest I may have a little protection – that I’m 2.9 times more likely than average to be someone who’s body can control HIV.

The report said I had a 72% chance of having blue eyes, and if I didn’t have blue eyes there was a 27% chance my eyes would be green, with brown being highly unlikely. Well, I had blue eyes as a kid, but now my eyes are green. I also found out that I don’t taste some bitter things the way other people do and that affects my food preferences.

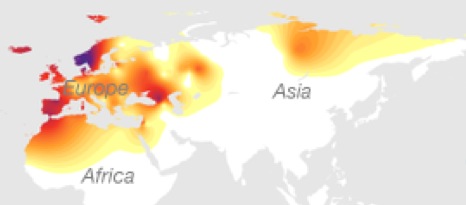

Then they break down my family history. I had always been told my mom was Scotch-English and my dad was Scotch-Irish, but I had no clue what that meant. Were those Scots who went to England and Ireland (e.g. Chinese-Canadian are Chinese that moved to Canada), or was it a mix of Scotch, English and Irish? Well, the report didn’t clarify those questions, but they did show me that my mom comes from Northern European ancestry and my dad comes from more Eastern European ancestry. Here’s the map of mom’s “Scotch-English” ancestry – she’s haplogroup H1…

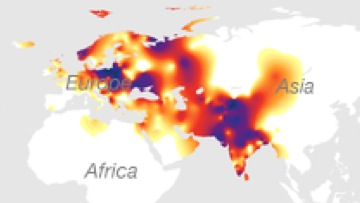

And here’s the map of dad’s “Scotch-Irish” ancestry – he’s haplogroup R1a1a (the most common group in Europe)…

The report goes on and on and on (they map over 900,000 points on the genome)… In most cases the results were average and not all that interesting, but there was enough that was interesting that I’m glad I took the test. Knowing my risk of prostate cancer justified getting the test all on it’s own.

I got the test during a holiday sale back in December. It cost a total of $170. They used to charge $500, but reworked their technology so they can do moer data points (900,000+ rather than 300,000+) at a lower price. The price has gone back up by $100, but still lower than it was. There are some big names behind the company including Google and some big well known biotech firms. If you’re interested, I suggest you try it. However, if you live in New York the test is illegal. They can mail it here, but you have to go out of the state to spit into the test tube and mail the test.