Harlem Bespoke just pointed out that 11 West 119th Street sold recently – for $400,000! That might seem like a low price, but actually it’s a surprisingly high price. The building is 14′ x 38′ on a shallow 65′ lot. 14′ x 38′ x 4 stories = approx. 2,128 sq. ft. So the cost per square foot was $188/sq. ft. By contrast we bought ours a few blocks away for $118/sq. ft. If 11 West 119th had sold for our price per square foot the price would have been $250,000. The final asking price was $450K. I’m not sure why the buyer only got $50K off final asking when most people buying similar properties tend to get $150-200K off asking. (For example, we got $265K off what they were asking when we started bidding).

Harlem Bespoke just pointed out that 11 West 119th Street sold recently – for $400,000! That might seem like a low price, but actually it’s a surprisingly high price. The building is 14′ x 38′ on a shallow 65′ lot. 14′ x 38′ x 4 stories = approx. 2,128 sq. ft. So the cost per square foot was $188/sq. ft. By contrast we bought ours a few blocks away for $118/sq. ft. If 11 West 119th had sold for our price per square foot the price would have been $250,000. The final asking price was $450K. I’m not sure why the buyer only got $50K off final asking when most people buying similar properties tend to get $150-200K off asking. (For example, we got $265K off what they were asking when we started bidding).

During our search we went through the one 2 doors down – 7 West 119th Street. It was fully renovated with some high end finishes (Sub Zero fridge, but just “better than rental” cabinetry). It wound up selling for $1.0983M. It’s hard to figure out the square footage of #7. Officially it’s 2,794 sq. ft. so it officially sold for $393/sq. ft. However, the City has it’s length at 47′ when all it’s sibling neighbors are officially 38′. I don’t remember it being pushed out in the back and the permit they pulled said no enlargement was proposed. It’s on a lot with a diagonal back line – one side it’s 54′ deep, the other it’s 58′ deep. I remember the back yard basically being a small deck, but it the short side was definitely more than 7′ feet long. So I really think the square footage of #7 is smaller and more inline with it’s neighbors. On top of everything else they did a double height living room so it was probably under 2,000 of real square feet. If it were 2,000 sq. ft. then the price per square foot would have been $549/sq. ft. which is way over what the other comps support. By comparison the incredible one on Strivers’ Row went for $505/sq. ft.

11 West 119th is a SMALL townhouse that shouldn’t be made into more than a single family home (#7 was made into a 2 family with a tiny studio apartment and I think it was a mistake). It’s not not in a historic district (though it is literally adjacent to a one). It’s steps from East Harlem where values are somewhat lower. It’s across the street from (relatively nice) public housing. So I’m not seeing how the property commanded $188/sq. ft. But with both #7 and #11 selling way over what the comps support — apparently they’re smoking really good over at that end of West 119th Street! 😉

No matter – this is a great comp for those of us who own townhouses. Be happy! And for the new owners of #7 and #11 West 119th Street – the values will go up in the coming years and they’ll still make money when they sell.

But honestly – if you’re looking to buy a Harlem townhouse shell – get a damn good real estate broker and a subscription to Property Shark that includes comps and really get to know what things are actually selling for (as opposed to what they’re listed for). A Property Shark membership is WAY cheaper than overpaying for real estate.

This townhouse is one that we kept coming back to. There were times when we thought we might not be able to afford to get a townhouse and when those times came up 505 West 144th Street was always one of the ones we’d bring up that we could afford. In many ways it was the financially safe option.

This townhouse is one that we kept coming back to. There were times when we thought we might not be able to afford to get a townhouse and when those times came up 505 West 144th Street was always one of the ones we’d bring up that we could afford. In many ways it was the financially safe option.

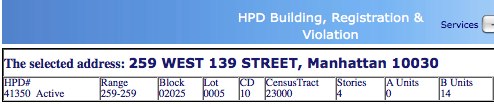

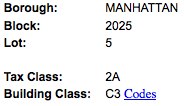

I am SO tired of real estate agents giving false and inaccurate information on their listings. It’s really not that hard to find out the truth. But it’s common for real estate agents to answer the question “Is there a certificate of no harassment in place?” with “the building can be delivered vacant”.

I am SO tired of real estate agents giving false and inaccurate information on their listings. It’s really not that hard to find out the truth. But it’s common for real estate agents to answer the question “Is there a certificate of no harassment in place?” with “the building can be delivered vacant”.