Last night I started looking through ACRIS at our house’s history. I had looked at some of it before, but not really tried to fully understand it. It’s had a pretty rough life, though the records only go back to the mid-70s (when NYC was going bankrupt)…

1884 -Our house was built along with 6 others that are adjacent to it. We really don’t know anything about it’s early history.

1884 was also the year The Dakota was built at 72nd and CPW and about the same time that Thomas Crapper popularized the indoor flush toilet (we’re not sure whether our place had an indoor toilet initially or not). 1884 was also a mere 19 years after the end of the Civil War.

March 1966 – The building was given a vacate order because it had been vacant for over 6 months…

adm code above premises has been vacant and untenanted except for caretaker for 60 days or more, and cannot be reoccupied until a new certificate of occupancy has been obtained. premises has been vacant since aug 26 1965.

That vacate order still has not been cleared. What this means is that our building has been a troubled building for longer than I’ve been alive – pretty amazing, when you think about it…

April 1968 – Following the death of Martin Luther King, Jr., a race riot raged around our place with major disturbances along 125th Street in the vicinity of 8th Avenue (FDB), 7th Avenue (ACP) and Lenox Avenue. Mayor Lindsay was almost overtaken by an angry mob just a few blocks north of our place at 127th Street and 7th Avenue. Many stores were looted on 125th Street and Lenox Avenue. This riot was the last straw for many shop keepers who closed their stores permanently – deciding it wasn’t worth the risk to do business in Harlem. The next 10 to 20 years was the darkest time in Harlem’s history.

October 1975 – The City of New York went bankrupt. The fiscal problems that followed hit Harlem very hard.

November 1976 – Joseph Monroe (who lived in the apartment building next door) put a mechanic’s lien on the building.

July 1977 – Harlem was in chaos for two days during a city-wide blackout. While police protected most white neighborhoods, in Harlem there was widespread looting. Following the blackout Harlem looked like a bomb-out, war-torn city. More and more residents moved out of Harlem and landlords found it difficult to get enough rental income to maintain the buildings, which only made things worse. Ed Koch leveraged the blackout to get elected mayor a few months later. He put severe austerity measures into place that brought the City back to life fiscally, but those austerity measures cut vital programs in Harlem and made Harlem’s situation even worse.

July 1978 – Joesph Monroe wins his mechanic’s lien case and is given title to the building to settle the case. What’s most interesting is that it wasn’t clear at the time of the court order who owned the building. 4 owners were named (Kilroy Jones, Catherine Quillinan, Peter Quillinan, Percival E. Vasquez), but then there were a whole bunch of John and Jane Does listed. The fact that they didn’t quite know who owned the building says it was already a troubled building.

The tax photo from 1980 shows that the ground floor was in use as “The Happy Game Room” and the storefront had not been added yet. So apparently Joseph Monroe fixed up the building somewhat and had it operating reasonably well. It was a good thing the building had a caretaker during this time – considering how Harlem was hitting rock bottom during these years.

March 1988 – Joseph Monroe died and the building was sold by his estate to Zion Temple Church, Inc. for $40,000. What’s odd is the deed said $125,000 but someone crossed out $125K and wrote in $40K. How can you make an $85,000 adjustment to the price after you type up the paperwork for the sale? Something was off or shady about that transaction… [It’s also worth noting that Zion Temple Church, Inc. was just incorporated a few months before – in December of ’87. What legitimate church buys townhouses 3 months after coming into existence?]

This is when things start getting really interesting… In the mid to late 1990s, when the building was owned by Zion Temple Church, our building was a drug house. So clearly Zion Temple Church was at best neglectful, and at worse they were slumlords who were OK with the drug activity in the building.

March 1994 – The second vacate order was issued.

December 1997 – The third vacate order was issued. We guess it was around this time that a neglected child was found in one of the closets in our house. That alone would be grounds to get everyone out of the building.

July 1998 – The fourth vacate order was issued. We know there was a fire in the building around ’97/’98. We suspect this is when the fire happened and it was at this point that people stopped “living” (doing drugs) in the building.

What’s really sorta disgusting is that all of that happened while a church owned our building. Talk about “missions start at home” – if they were real Christians they should have started practicing their religion at the buildings they owned.

Curiously, one guy from down the block stopped by just after we bought the building and said he used to live in the building. Then he hesitated and said “well, I sorta lived there”. Given what “living” in our building meant back then – I’m just glad he’s alive and appears to be doing OK…

February 1999 – After owning the building for 11 years Zion Temple Church sells the property to “168 West 123rd St. Realty Corp” but the address is “c/o Maywood Capital” in Paramus, NJ. The sale was for $0. Maywood Capital was convicted for fraud in 2005… Quoting the Attorney General of NJ…

The defendants placed newspaper ads offering interests in “safe” mortgages. Joseph Greenblatt solicited investors in the states of California, Florida, Massachusetts, New Jersey and New York, among others, to invest in residential properties in New York City that were in need of repair. The ads claimed the investments were ideal for IRAs, Keoghs, pensions and personal portfolios.

Corporations formed by the individual defendants would allegedly purchase properties for renovation and/or resale through Maywood Capital. Investor funds were purportedly invested in the entity owning the property and secured by mortgage interests in the property. In reality, many of the properties controlled by the defendants were over-mortgaged and did not produce the unrealistic profits promised to investors. In many cases, investors’ mortgage interests were never recorded or were extinguished without their knowledge so that new investments could be secured by mortgages on the buildings in question. In certain cases, the defendants did not even own the properties that they mortgaged to investors.

There was $42M in fraud and our place was in the center of it all since it was one of the buildings Maywood was telling it’s investors it was fixing up.

The fact that Zion Temple Church owned a crack house and sold the property for $0 to someone who was engaged in fraud makes Zion Temple Church appear to be party to the fraud. But honestly I don’t know what their role was – I’d like to learn more…

August 2002 – While the Attorney General of NJ hadn’t won his case yet, other things were happening with the building legally. I don’t know the particulars, but there was a court order and somehow Beulah Church of God In Christ Jesus, Inc. got our building along with 12 others in similar condition. If I had to guess I’d say they must have invested in Maywood and they got some of the collateral in return for their lost investment in the fraudulent scheme. But again, I don’t know what happened. I do know that one of the lawyers going after Maywood (James E. Hurley) was their lawyer and he helped them sell the buildings a couple years later…

November 2004 – Clearly Beulah didn’t want to actually own the buildings, so they sold them pretty quickly. The buyer of our building was “148 West 121st Street Associates LLC” which was c/o Tahl Properties (a big Harlem landlord). As you might guess from the name of the buyer Beulah sold both our building and 148 W 121 at the same time. The purchase price for both buildings was $1,130,434. That means the value of our building at that time was roughly half that.

July 2005 – Tahl Propp actually bought all of Beulah Church of God in Christ Jesus’ townhouses – they just bought them in several small transactions. Once all the legal issues were resolved Tahl Propp transferred ownership of all of the buildings under one LLC – TPE Townhouses Harlem.

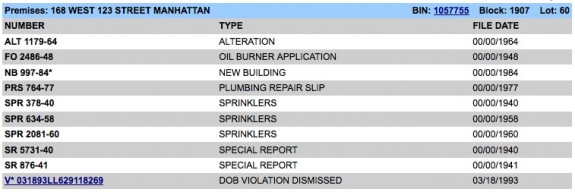

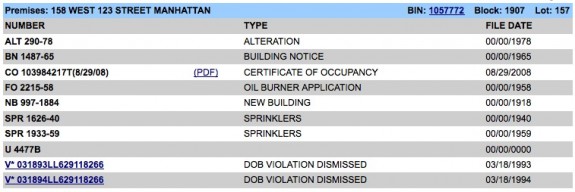

Tahl Propp took out big rehab mortgages, but as a big developer the money just went into their operating budget. They started getting plans done on some of the buildings (including ours). They even pulled permits in 2007 to convert our building to two family and add a floor to the building. They did demolition, then stopped.

Then the market crashed in 2008 and Tahl Propp put all but two of the townhouses on the market.

March 2010 – We bought the place.

Apparently 168 (our house number) is supposed to be a lucky number in Chinese, but so far our building hasn’t had much luck. Since Dan’s Chinese maybe it takes a Chinese person buying a place to make 168 give you good luck… Then again maybe not – in talking to an expediter yesterday she said it sounded like we had been “particularly unlucky” in our dealings with the DOB. I’m hoping the building’s luck will change in the near future…

Construction is starting today! Later this afternoon I’ll go down to see the new construction fence… 🙂